Growth and scope

Growth of forest assets

By 2035, our goal is to own and manage a total of 1,000,000 hectares of forests, which is a 25% increase from the current level. The main focus of this expansion is on Finland.

Revenue development

Our revenues are expected to grow to over EUR 400 million, and wood sales is expected to account for 90% of net sales, with forest services supplementing the remaining 10%.

Financial stability and profitability

Strong profitability

Our goal is to maintain strong profitability, with operating profit exceeding 70%.

Increasing dividends

Annual dividends increase, providing shareholders with predictable returns.

Strong balance sheet

Our balance sheet will grow by 25%, to approximately EUR 5 billion, with a strong equity ratio of over 50% and an IG credit rating for our loans.

Sustainable development

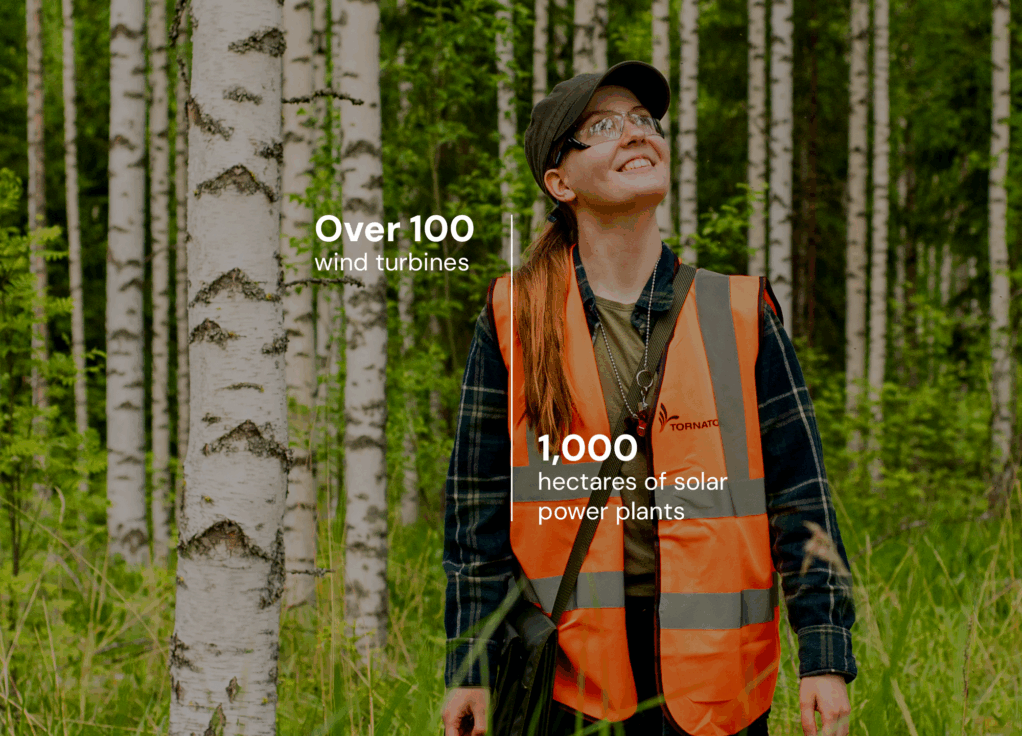

Renewable energy and land rental income

In accordance with our climate strategy, more than 100 wind turbines and 1000 hectares of solar power plants will be built on our land. These produce clean energy and create steady land rental income.

Promoting forest biodiversity

The set goals of the Biodiversity Programme will be achieved, and at the same time, we are actively building a new ambitious programme for the future.

Stable number of employees

We are utilising our strong network of contractors, so no significant changes are expected in the number of employees.

A healthy organization

We invest in a well-managed and healthy organization at all levels.

Digital Empowerment

With the help of AI agents and digital development, we are significantly streamlining our processes.

Optimizing processes with AI

Remote Sensing Data

We use advanced remote sensing data to support decision-making and efficiently manage our resources.

Artificial intelligence solutions

We integrate AI solutions into our core processes, bringing smart tools into our daily operations.

Improved efficiency

Digital tools improve efficiency, accuracy, and speed up decision-making in all areas of the business.

Tornator in 2035

Turnover

400 m€

Balance sheet total

5 bn €

Credit Rating

IG

Operative operating profit

300 m€

Annual dividend

>100 m€

Equity ratio

>50 %

Net operating profit

200 m€

Annual dividend growth

3-6 %

Loan to Value

<50 %